This is a very difficult one for any property professional to call. There are simply so many factors swirling around, domestically and all around the Globe. Uncertainty is the enemy of both financial and property markets. But let’s start with some good news!

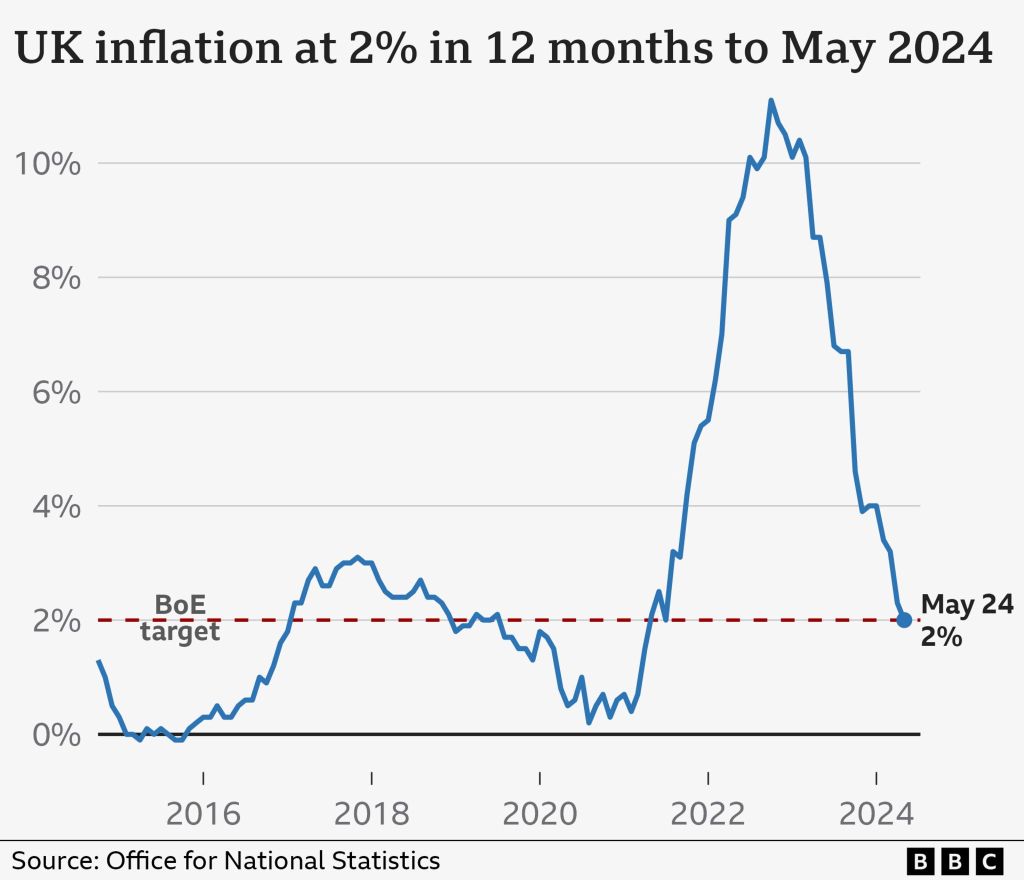

Inflation is falling fast. In fact it has fallen to the lowest level in three years and according to the Office of National Statistics today has finally hit target of 2%. Whether the Bank of England Monetary Policy Committee have such an optimistic approach and decide to cut interest rates remains to be seen. It is highly unlikely that interest rates will come down quickly or fast enough for mortgage holders’ liking. Combined with the cost of living this will surely keep the brakes on house price inflation for the foreseeable future.

General Elections are always a cause of uncertainty, especially when a change of Government seems almost certain. The build up to an election creates a temporary hiatus in the housing market and is testament to the current lack of viewings, offers and sales. One of the biggest concerns amongst buyers after interest rates is tax, particularly Capital Gains Tax, Stamp Duty and Inheritance Tax. All three have such a huge bearing on the property market. Kier Starmer may have made pledges on not raising other taxes, but this trio may all come under the microscope – another red warning light for the housing market.

UK buyers and sellers are experiencing a much more challenging time buying and selling houses. The post Covid bubble has well and truly burst and there is an increasing amount of stock, much of which is way overpriced and unlikely to sell. Sellers need to be much more realistic with pricing as the numbers of buyers continues to dwindle. With a few exceptions noted, it is well and truly a buyers’ market. Furthermore in coastal and holiday hotspots the market is being flooded by former and existing holiday lets. Falling occupancy rates due to overseas travel, the abolition of tax relief on holiday lets run as businesses and worries about changes to Capital Gains Tax and Council Tax is putting further pressure on second home owners.

There may be a post election bounce, as has happened before. A fresh direction may provide some much needed optimism. But the growing problems we face such as the massive national debt, flatlining economy and high (and growing) tax burden are hard to ignore. When we also consider the parlous state of global relations and the drums of war beating it may be time to don our hard hats. Realism is the order of the day

Eastwood Property Consulting is an independent residential advisory service and acts for private individuals, trusts and executors. If you found this article informative, please feel free to share it.

Leave a comment